Unlocking the Future of Finance: How Gen AI Is Redefining Strategy, Efficiency and Leadership

The business landscape of generative artificial intelligence (Gen AI) has shifted dramatically in the relatively brief span of the past year. What was merely an exploratory concept and technological curiosity at the beginning of 2024 has quickly evolved into a strategic imperative for businesses around the world. Within organizations, finance teams have responded to this call for action with particular enthusiasm, which makes perfect sense in light of the changing role and status of finance within enterprises.

The stakes are higher than ever in finance departments, as the function’s standing has been rapidly rising. According to The Hackett Group’s 2025 Enterprise Key Issues Study, 65% of finance executives describe their department as a “valued business partner,” up from 41% in 2024. This shift underscores how enterprises are increasingly relying on finance for strategic leadership.

In the same study, 89% of executives across business functions said that their organizations are advancing Gen AI initiatives, up from 16% in the prior year. Together these figures go a long way toward explaining the enthusiasm within finance organizations for adopting Gen AI. That enthusiasm for Gen AI initiatives to drive innovation, agility and value creation is spreading, and as Gen AI-focused digital transformation is scaled across organizations, it will also be critical for finance executives to help meet one of the key challenges: to reimagine work and the workforce and determine where Gen AI can assist and augment finance employee performance, and where it can be deployed to work autonomously.

The Role of Gen AI in finance

Gen AI, with its intelligent assistants and autonomous agents, is poised to redefine how finance operates. Intelligent assistants use natural language processing to complete tasks for users, while agents perform tasks autonomously on behalf of users or systems. These technologies are not mere tools; they are strategic enablers. By using Gen AI to automate repetitive and transactional processes, finance professionals can focus their time and resources on higher value activities.

Defining Al

Assistants: Intelligent applications that understand natural language and use conversational interfaces to complete tasks on behalf of users.

Agents: Intelligent applications that perform tasks autonomously on behalf of users or other systems without the need for constant human intervention.

Together these tools are poised to revolutionize operations by enhancing efficiency, reducing manual errors and providing real-time insights that enable more agile decision-making.

Early wins and long-term potential

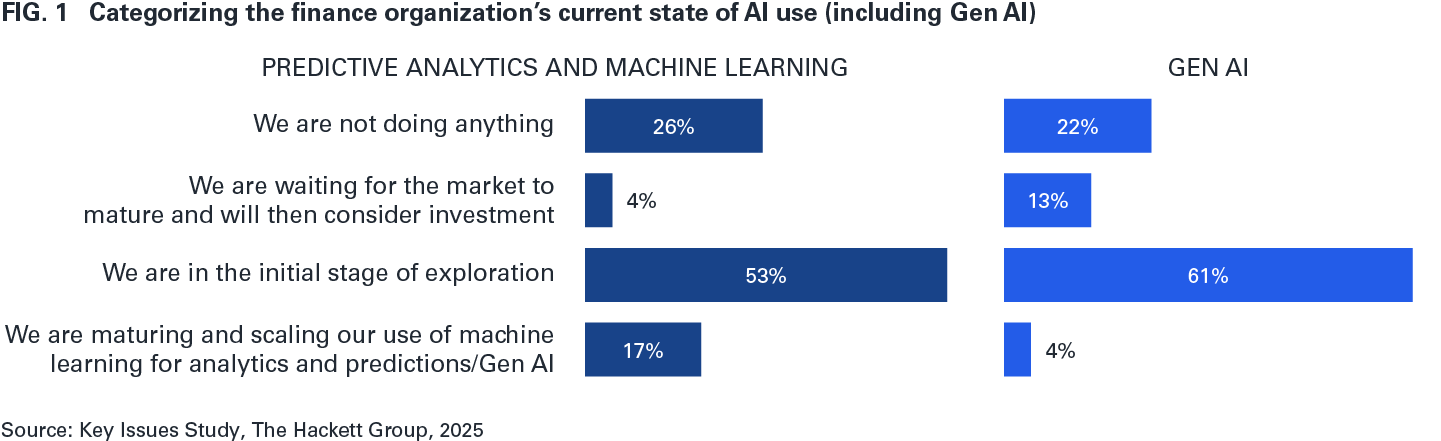

Although enthusiasm is high, most finance organizations are in the early stages of their Gen AI journey (Fig. 1). Exploration of predictive analytics, machine learning and Gen AI has been robust, but a significant number of companies are either waiting for the market to mature or are not yet taking action. This hesitation creates a significant risk of being left behind as more proactive organizations accelerate Gen AI adoption. The Hackett Group’s study projects a 20% net growth in Gen AI adoption within finance departments in 2025, signaling maturation is gaining momentum in some organizations. It is a moment of decision for those who don’t want to end 2025 as also-rans.

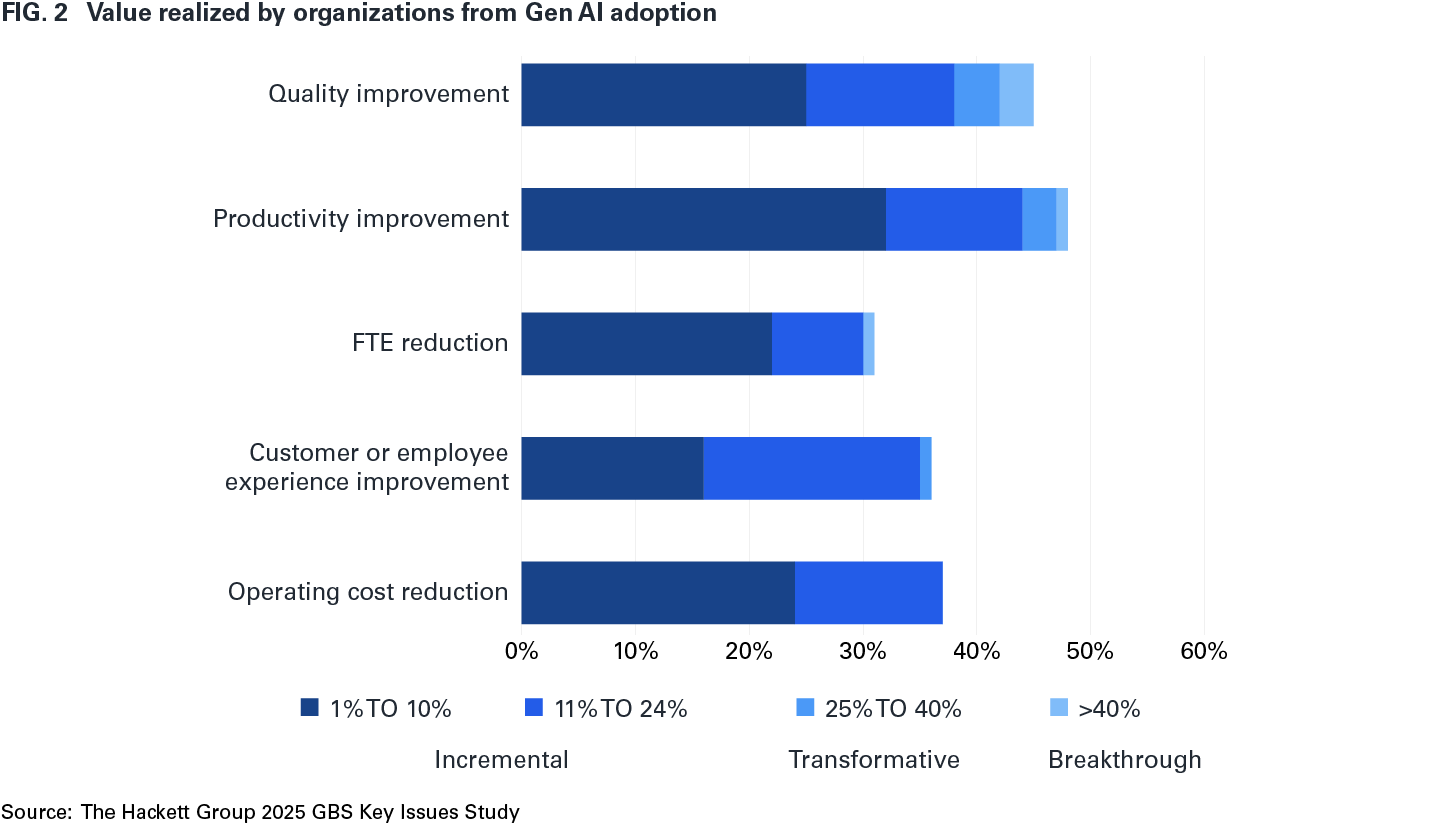

Even in the early stages of adoption, Gen AI is delivering measurable benefits to finance organizations. Given the function’s historical focus on incremental gains, the recent single-digit improvements in productivity, cost reduction and quality enhancement represent significant milestones (Fig. 2). A small but promising percentage of organizations report improvements exceeding 10% across key metrics, highlighting the potential for breakthrough value as adoption scales.

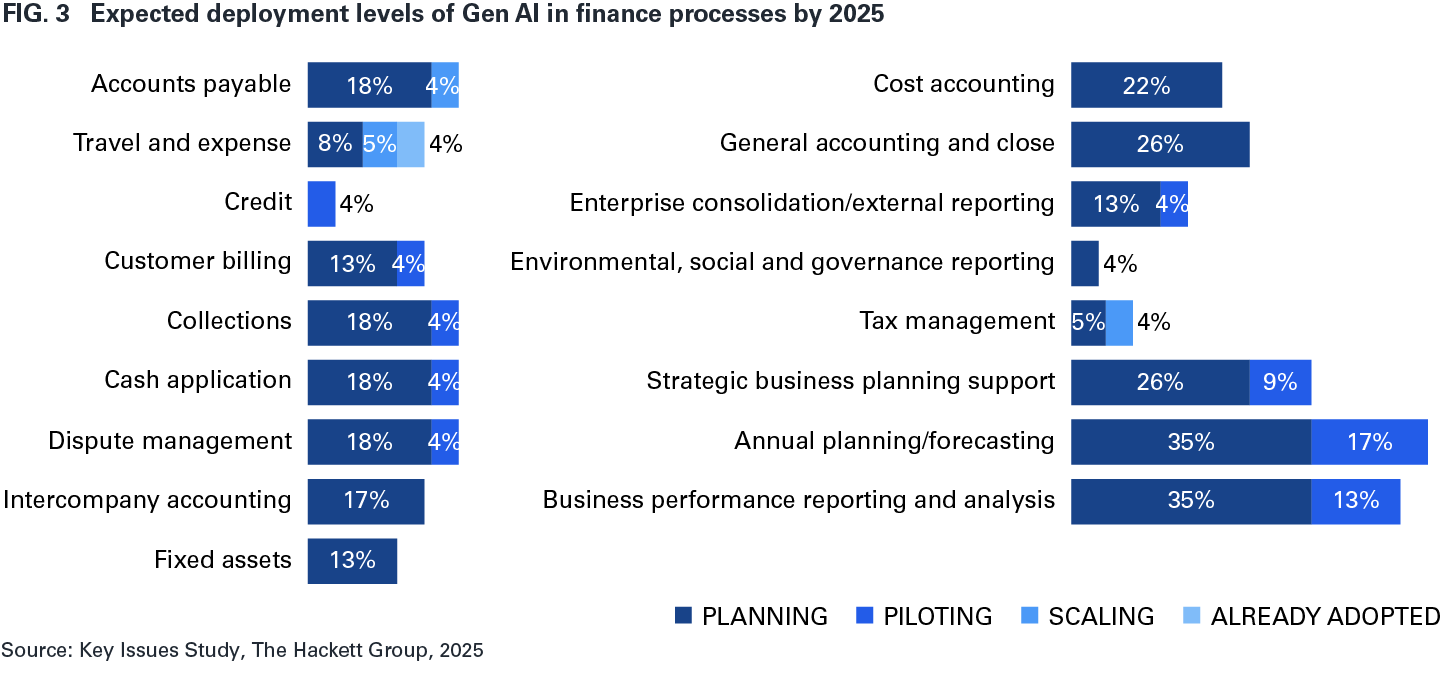

The early use cases undertaken by finance organizations include high-volume transactional processes such as cash disbursements and complex domains like tax management. Additionally, pilots in planning and forecasting are gaining traction, with expectations for broader deployment within financial planning and analysis (FP&A) processes. These initial successes illustrate Gen AI’s capacity to drive both operational efficiency and strategic insight.

Where Gen AI is being deployed in 2025

Gen AI adoption in finance-related processes is still in its early stages. In addition to cash disbursements and tax management, areas of Gen AI deployments beyond the pilot stage include general accounting and revenue cycle processes (Fig. 3). In each area, organizations will need to determine how Gen AI will best augment and assist the human workforce, and where it will be able to work autonomously.

GBS leaders are learning valuable lessons not only from their successes in pioneering Gen AI adoption within their organizations, but also from the challenges and obstacles they’ve encountered. These pain points have helped focus GBS decision-making and planning on developing strategies for overcoming and moving past these challenges. Those strategies will pave the way forward in 2025 and beyond.

Strategic priorities for finance leaders in 2025

The 2025 Finance Agenda and Key Issues Study highlights four primary mandates for finance leaders, all areas that can be improved upon with Gen AI: business performance, transformation and technology, core functional capabilities and talent development.

Cascading from this list, the top five priorities for finance organizations include:

- Optimizing cash flow performance and liquidity

- Accelerating digital transformation and modernizing technology

- Supporting profitability improvement goals

- Implementing cost optimization strategies

- Enhancing data quality and data analysis capabilities

These priorities reflect the dual challenge facing finance leaders: delivering immediate value while positioning their organizations for long-term success. Without the deployment of Gen AI, the road to balancing these priorities is harder.

Overcoming challenges in Gen AI adoption

Despite the promise of Gen AI, implementation presents finance leaders with significant challenges.

Key among these challenges are:

- Skills and talent gaps: A lack of AI talent and implementation expertise remains a major barrier.

- Data quality and complexity: Poor data quality and complex process landscapes hinder progress.

- Change management: Resistance to change and unrealistic expectations about AI’s potential benefits create additional hurdles.

- Ethical and regulatory concerns: Data privacy, intellectual property risks and ethical considerations require careful management.

Addressing these challenges requires a multifaceted approach, including investment in upskilling, process simplification and data ecosystem improvement.

Actionable steps for finance leaders

To harness the full potential of Gen AI, finance organizations must take immediate, strategic action.

The Hackett Group recommends six critical mandates:

- Develop a comprehensive Gen AI strategy: Align functional initiatives with enterprise-wide goals to ensure consistency and maximize impact.

- Prioritize use cases: Focus on practical, high-value applications, scale successful pilots, and continuously explore new opportunities.

- Set realistic expectations: Move beyond cost reduction to emphasize speed, agility and decision-making improvements.

- Strengthen data foundations: Build a robust data ecosystem to enable seamless insights and cross-functional collaboration.

- Address process and technological complexity: Simplify workflows and eliminate inefficiencies to pave the way for AI integration.

- Invest in talent development: Equip finance teams with the skills needed to thrive in an AI-driven environment.

It’s time to reimagine work

Gen AI is no longer a distant, speculative concept – it is an immediate, real-world imperative. Organizations that respond to that imperative and integrate AI into their operations now will gain a substantial edge over the competition. While the risks associated with AI adoption are real, they can be managed with proper planning and execution. The greater risk lies in failing to act. And the greatest risk is an organization not reimagining their work, workforce, performance and competitive advantage as they scale Gen AI.

By adopting a structured approach to ideation, use case development and implementation, finance organizations can rethink how they work, deliver enhanced value, and secure their role as strategic catalysts for the enterprise. Across the rapidly evolving landscape of 2025 and beyond, one thing is clear: it’s critical to embrace Gen AI now.

It’s time to act. Contact us for more information or to schedule a demonstration.