Building the Next-Gen FP&A Operating Model

The pandemic has shined a spotlight on the role of FP&A in helping the company keep up with rapidly changing conditions, providing forward-looking insight, and assisting the business in charting a course forward. Covid-19 has thus accelerated the ongoing transition to a more integrated and collaborative FP&A service delivery model. FP&A teams must work more closely with their business counterparts and become strategic advisors to the business.

The trend toward an effective partnership with internal stakeholders has been long in the making. However, it had been slow to progress. Now, we have a burning platform which can help FP&A executives advocate for a new type of relationship between finance and the business.

The problem is that many of today’s FP&A organizations are not where they need to be. At a January 2021 meeting of the London/Ireland Digital FP&A Board, hosted by FP&A Trends, only 21% of nearly 400 participants reported they have made steps toward adopting collaborative FP&A. Just over a third said they plan to over the next few years. On a more upbeat note, 45% reported they have taken steps to modernize their systems and structures in preparation for the transition to a more integrated model.

I had the pleasure of participating in the meeting as a panelist, along with David Williams, Vice President at SAP, Kerryn Haynes, Divisional Finance Director at Oxford University Press, and Ash Sharma, Finance Director at Walgreens Boots Alliance. The discussion was moderated by Larysa Melnychuk, Founder and CEO of FP&A Trends.

Each panelist brought his/her expertise and experience, but the message was unanimous: Traditional FP&A staff and management accountants need to develop new skills, adopt new technologies, and embrace new engagement models with their business counterparts. The Hackett Group’s 2021 Finance Key Issues Study revealed that CFOs’ number-one objective for this year is improving finance’s role as strategic advisor to the business.

DRIVERS OF CHANGE

Next-gen FP&A is no longer a matter of choice. It’s an imperative. Some of the forces driving this evolution include:

- Unparalleled level of business and economic disruption

- Rising availability of predictive analytics tools

- Accelerated digital transformation

- Greater awareness of the need for agility/adaptability

While this may present a challenge for organizations still stuck in the traditional accounting mindset, it’s also good news. The crisis has greatly elevated the role of FP&A within the company. That is because it’s essential for business leaders and senior management to: understand current performance and dig into root causes; keep pace with fast-changing conditions, and make informed and quick decisions on how to transition the business to the next normal.

The Hackett Group’s research shows that executives are not expecting things to stabilize any time soon. Our study found that 46% of G&A executives don’t expect conditions to return to some normalcy before the second half of this year, and 36% think it won’t happen until sometime in 2022.

Because of this high degree of uncertainty, FP&A’s stakeholders are demanding near real-time and future focused insight, so they can make strategic plans and choices about resource allocation. Finance executives listed the accelerated pace of change and its impact on planning as the number-one disruptor to finance operations in the immediate aftermath of the pandemic. Number-two was rising demand for forward-looking information. Another driving factor has been the speed of digital transformation and the proliferation of modern planning solutions. Thus, FP&A cannot just do things the way it’s used to. It must adapt by becoming more agile.

THE NEW OPERATING MODEL

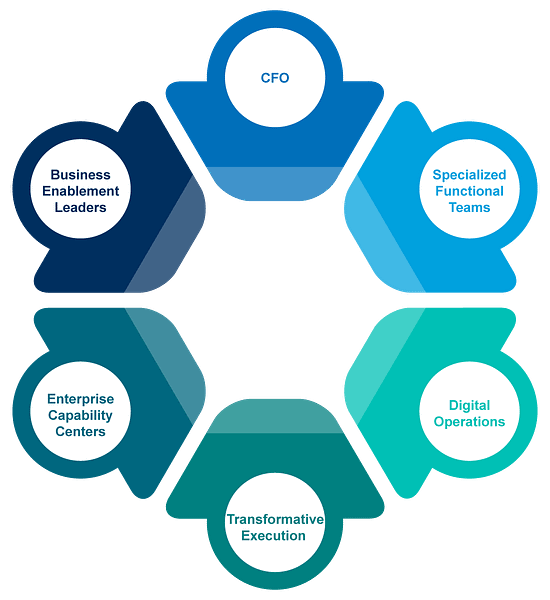

To understand the evolving role of FP&A, we must look to the future finance organization’s operating model. The Hackett model below has a couple of broad themes: 1) It is enterprise vs. primarily functionally aligned, and it recognizes the need for built-in transformation “force multipliers.”

The FP&A teams of tomorrow won’t look like the teams of today.

- They will be the prime leaders of business enablement by getting a permanent seat at the decision-making table, for example when making investment decisions, selecting projects and planning headcount.

- They will expand the delivery scope of analytics from mostly other parts of finance to all functions and business units, effectively becoming the analytics hub of the organization, or what we call Enterprise Capability Centers, or ECCs.

- They will standardize and automate much of repetitive reporting activity and first-line analytics and migrate those activities to shared services centers (SSCs) or “digital operations.”

- They will provide self-service analytics tools to business users so they can get quick answers to pressing business questions.

HOW TO GET THERE

Of course, the big question is what it would take to get to this next-gen organization. While there is no silver bullet, here are multiple components required to realizing the future FP&A vision. According to the panel members, those involve a combination of a new engagement model, new skills and new technologies.

Engagement model: In The Hackett Group’s January 26 Webcast focusing on our Key Issues Study, we asked participants about the steps they intend to take to improve their role as strategic advisors. Number-one was creating a clear interaction model so that FP&A and its stakeholders can institutionalize the way they communicate, for example, by assigning specific staff to relationships with specific business units or functions, or dedicating full-time employees to business partnering roles.

Simplify the information flow: To make sure information is meaningful to business leaders, FP&A ought to simplify reporting by taking inventory of current state reports and identifying which can be discontinued, which to keep and update, and any new ones the business may need. Shrinking the number of reports is sometimes as simple as stopping to issue them and seeing if anyone complains. In addition, reports should be customized to the needs of different stakeholders, in terms of frequency, content and granularity, and delivered through visualization tools to make them more digestible and offer drill-down capabilities.

Transition to EPM in the Cloud: It’s also important to modernize the EPM tool set, from excel or legacy applications to the deployment of cloud EPM solutions. The latter can cut through data silos and distribute access to rich functionalities to multiple stakeholders. According to Williams as SAP, the adoption of EPM in the cloud solutions delivers many benefits, including faster and more accurate financial close and more agile and aligned planning. In addition, the deployment of modern EPM systems can help FP&A filter through vast amounts of information and make sense of it more quickly to enable fast decisions. We see signs of this already happening. The Hackett Group’s latest research shows that between 2016 and 2020, the moderate or full-scale adoption of cloud EPM solutions nearly doubled.

Upskill staff: Emerging technologies and a new service delivery models demand a whole new set of skills for FP&A professionals. Without upskilling people, advanced technologies or clear interaction models won’t really work.

According to Sharma at Walgreen Boots Alliance, some of the skills of the future include:

- Mastery over systems, analytics tools and data management solutions

- Versatile communication skills

- Deep knowledge of accounting and performance management

- Insatiable desire to solve business puzzles

- Versatile communication skills

When we asked the meeting’s participants to rank the biggest gaps between current and next-gen skills in their organizations, technology and data savviness were at the top, followed by analytics and modelling. Only 15% cited communication and storytelling. These results are concerning. While digital savviness and analytics acumen are critical, without being able to communicate insights to the business effectively, FP&A will not influence decisions. The whole point of the new FP&A operating model is to become an effective advisor. Because FP&A doesn’t have decision-making authority in most cases, it must find ways to influence them, by making a strong case for change.